To calculate your federal withholding tax, find your tax status on your W-4 Form. … The IRS states that in this case, the employee can use Form W-4 to tell an employer not to deduct federal income tax. Are employers required to withhold federal taxes?Įmployers are generally required to withhold money from an employee’s pay for income tax purposes, whether the employee is paid hourly or on a salary basis. For example, if Matt earns an hourly wage of $24 and works 40 hours per week, his gross weekly income is $960. Divide that number by 12 to get your gross monthly income. Multiply your hourly wage by how many hours a week you work, then multiply this number by 52.

2020 federal tax tables how to#

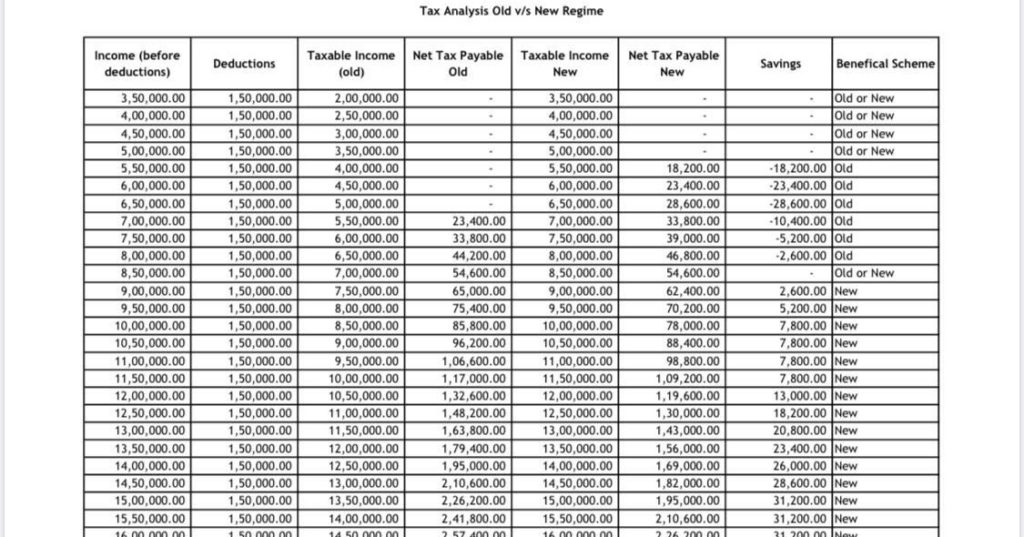

You might be interested: How To Save Tax In India? (Best solution) How do I figure out my monthly income?

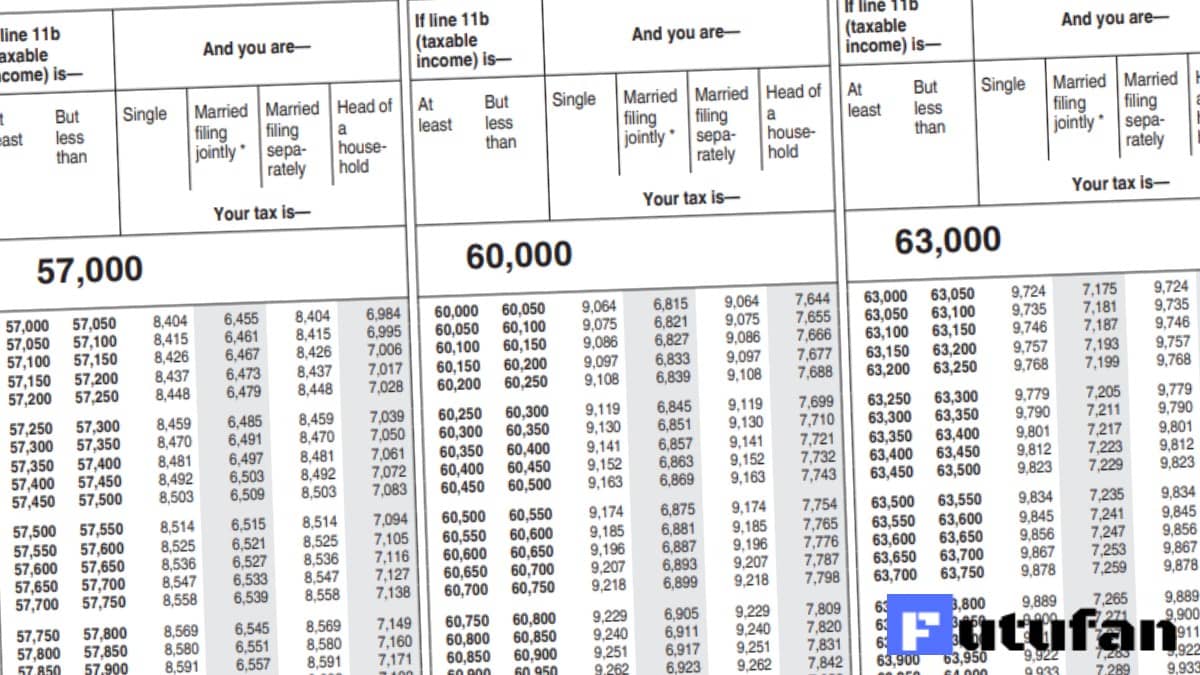

What is the federal withholding allowance for 2020? The information you give your employer on Form W–4. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. What are the federal withholding taxes?įor employees, withholding is the amount of federal income tax withheld from your paycheck. The 2019 employer and employee tax rate for the Social Security portion of the Federal Insurance Contributions Act taxes is 6.2 percent, unchanged from 2018, Notice 1036 said. The withholding tables have tax brackets of 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. What is the federal income tax withholding rate for 2019? Social Security tax withholdings only apply to a base income under $127,200. Both taxes combine for a total 7.65 percent withholding. This all depends on whether you’re filing as single, married jointly or married separately, or head of household.What is the percentage of federal taxes taken out of my check?Īt the time of publication, the employee portion of the Social Security tax is assessed at 6.2 percent of gross wages, while the Medicare tax is assessed at 1.45 percent.

The federal withholding tax rate an employee owes depends on their income level and filing status.

0 kommentar(er)

0 kommentar(er)